But what are the advantages of a Greenfield investment?

Certainly among the advantages of greenfield investments we can safely say that they give investors more control than investing in an existing local business, as well as the opportunity to form marketing partnerships and avoid intermediation costs.

Greenfield projects are an excellent way to make foreign direct investments (FDI) and are often used to expand in emerging markets.

They usually involve a parent company setting up a subsidiary in the foreign country. Coca-Cola and Starbucks are examples of multinationals that have made numerous greenfield investments all over the world.

When Greenfield investments matter

The investment Greenfield is an alternative to foreign portfolio investment in which an individual or a company simply buys the shares or bonds of an existing company. It is also an alternative to investing brownfield in which an investor acquires an existing business or production facility.

Investors undertake greenfield projects when there are no acquisition opportunities in the target market, or when market research shows that there is little local competition in a particular line of business.

KEY POINTS

- A greenfield project gives the investor full control on investments foreign direct.

- This control includes the freedom to set prices and establish a marketing strategy.

- Greenfields also avoid the need for intermediaries and in some countries can even receive tax breaks like in Kribi.

A means of greater control

A greenfield company provides the investor with control over the business in several ways that he would probably not have if he simply invested in an existing local company. One is to establish a global strategy, for example, by determining what type of product or service will be sold and then setting production rates and the pace of expansion in the target market.

For example, the investor can decide whether he wants to start a small-scale activity and gradually increase his presence or prepare for a large-scale launch of its products. It would normally not have such freedom of action if it were to invest in an existing local enterprise.

Investments greenfield allow easier and more effective adaptation to the foreign market. The investor can adapt both products and prices to local conditions and has more control over insurance of product quality. Having complete ownership of a subsidiary allows the investor to extend offers to customers or potential customers, as discounts or guarantees, as market circumstances dictate.

Other benefits

A local presence can also facilitate the adaptation of advertising and marketing efforts to the local market environment and the formation of partnerships with local companies to increase market penetration.

It also allows the investor to almost completely avoid the cost of using intermediaries such as credit institutions or other investors. Depending on the economic policies of the country, companies may also benefit from government tax incentives aimed at attracting foreign investment.

The flip side of the coin

Greenfield investments are one of the riskiest forms of FDI. Some countries ban FDI altogether in certain politically sensitive sectors.

But even where it is allowed, there can be high barriers to entry, such as 'local content requirements' that require foreign companies to use domestically manufactured components or domestically provided services to doing business.

Greenfield projects usually have high fixed costs because they often involve building structures from scratch (hence the term).

They are also more vulnerable to political risk because it is more difficult to divest from a wholly owned production plant, for example, than to sell a passive portfolio investment in a local company.

Managing risk in Africa calmly and professionally

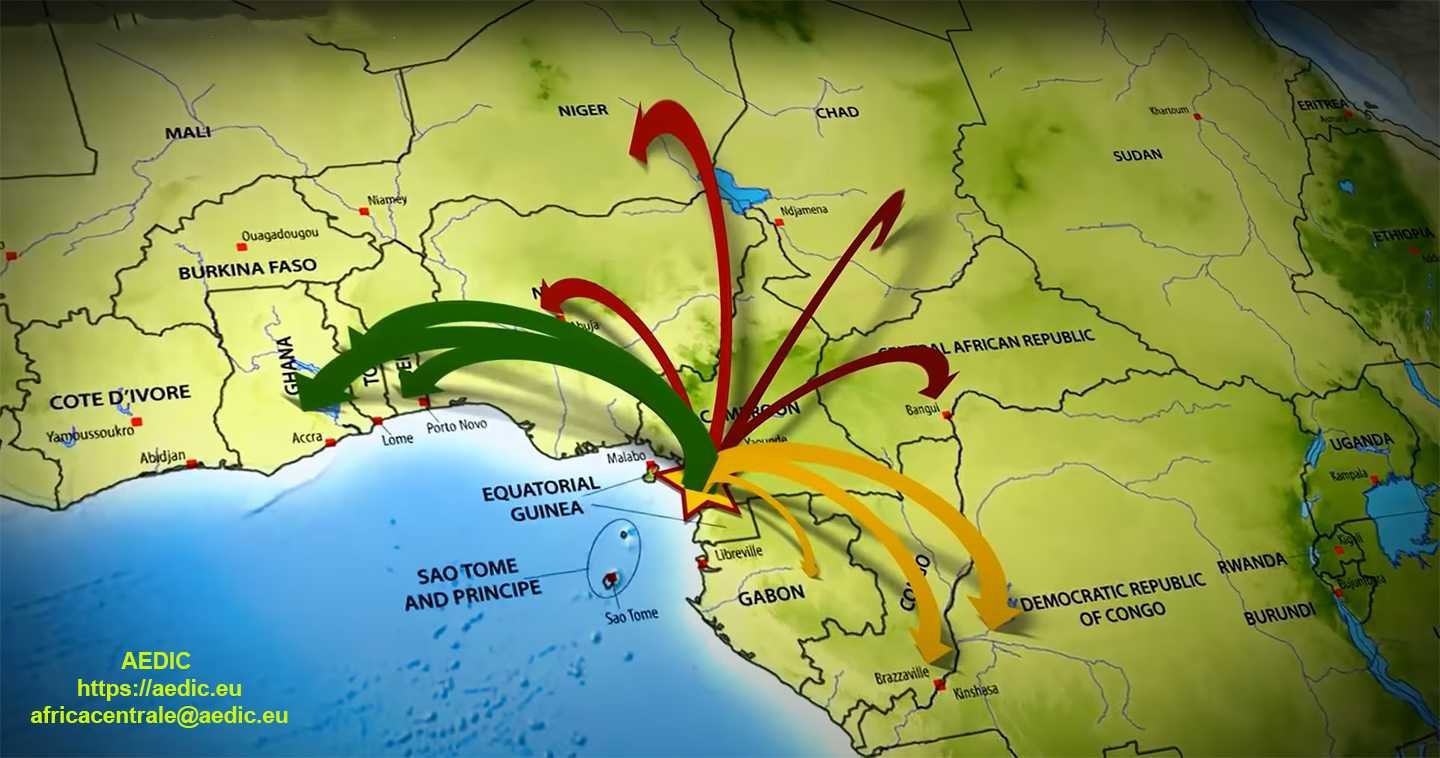

For every economic breakthrough, AEDIC offers the opportunity to enter in a safe harbourwith tax and concession advantages, and low cost of specialised labour, centrally located in AFRICA.

When you have decided to act, we provide you with all the essential risk management tools throughout the investment lifecycle.

Aedic with its consultants has the ability to get you in and take position where the industrial city of Kribi in central Africa.

Watch this video to better understand what we are talking about.

[su_youtube url="https://www.youtube.com/watch?v=P0savsBM0CA" title="investing in africa in Kribi (Cameroon)"]

Managing risk in Africa calmly and professionally

Thanks to important institutional recognitions and collaborations with port agencies, for your economic breakthrough in Africa, AEDIC offers the opportunity to enter a safe harbour, with tax benefits and tax relief for 10 years, concessions and low cost of highly educated skilled labour in position central in AFRICA.

When you have decided to act, we provide you with all the essential risk management tools throughout the investment lifecycle.

Aedic with its consultants has the opportunity to bring you into Central Africa and take a position where the industrial city of Kribi will be built.

Watch this video to better understand what we are talking about.

what do you want to do now?

if you wish to get in touch with us to develop your business opportunity in Africa, please fill in the form below and one of our consultants will contact you within 24 hours