In this article we will provide an analysis of the two modes of investment in Africa. Greenfield vs. Brownfield

So Greenfield vs. Brownfield which of the two modes is more convenient for the your company's investments in Africa?

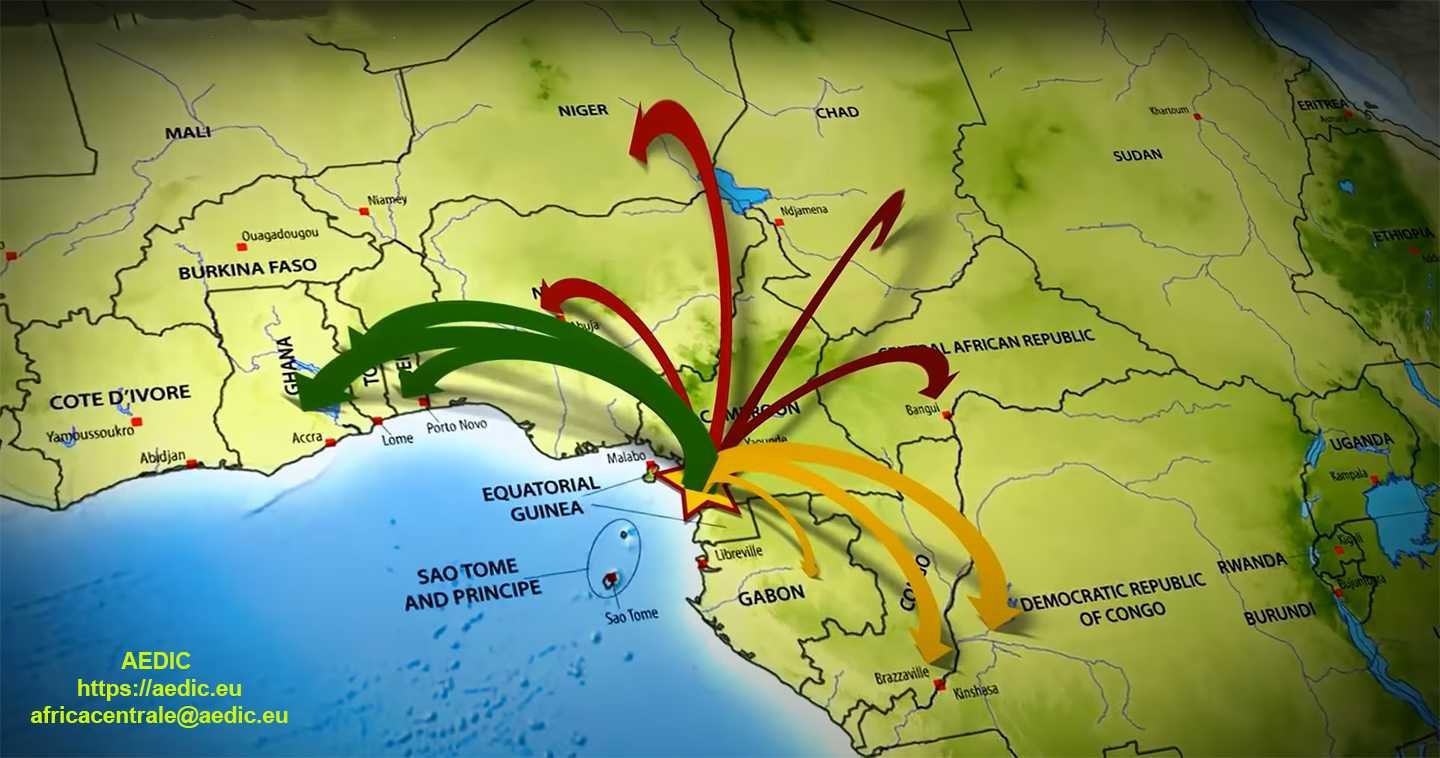

The industrial zone of Kribi and other areas of economic interest in Central Africa normally see theestablishment of companies who wish to expand their interests internationally generally make direct investments in another country.

This phenomenon economic is also known as a form of direct investment in the foreign host country (FDI).

These large companies buy, rent or acquire assets in the foreign host country, including facilities such as plants, office space or other types of buildings. These acquisitions may be in the form of new structures or in the form of existing structures on site.

In the business world, these investments are called greenfield and brownfield investments. But what exactly are they and how do they differ?

If you are interested in finding out more read on on investments greenfield and brownfield and the main differences between the two.

KEY CONCEPTS

- Greenfield and brownfield investments are two types of foreign direct investment.

- With the greenfield investments, a company will build its own brand new facilities from scratch.

- Brownfield investments occur when a company buys or leases an existing facility.

Greenfield vs. Brownfield Investments: an overview

As you may have noticed above, the greenfield and brownfield investments are two different types of foreign direct investment. Both involve companies and production plants in different countries. But that is mainly where the similarities between the two end.

In a greenfield investment, the parent company opens a subsidiary in another country. Instead of buying an existing structure in that country, the company starts a new enterprise by building new facilities in that country. Construction projects may include more than just a production facility. Sometimes they also involve the completion of offices, housing for the company's staff and management, and distribution centres.

Investments in brownfield sites, on the other hand, occur when an entity purchases or leases an existing facility to begin a new production. Companies can consider this approach a great time and money saver as there is no need to construct a brand new building.

If you wish to activate procedures Greenfield in Africa the company will have to apply for concessions and follow a precise procedure to obtain authorisations accompanied in this process by our group at local institutions and the port authority for investments greenfieldIf the company wanted, it could also skip this step by making an investment brownfield in the area where the exact conditions are located, but in the area of Kribi the business opportunity is greenfield.

Greenfield Investments

The term greenfield refers to buildings constructed on fields that were, literally, green. The word green is also synonymous with the word new, which can allude to new construction projects by companies. These companies are generally multinationals starting a new venture from scratch, especially in areas where there are no existing facilities.

There are several reasons why a company may decide to build a new facility rather than buy or rent an existing one.

The main reason is that a new structure offers design flexibility together with efficiency to meet the needs of the project. An existing structure forces the company to make changes according to the current design. All capital goods must be maintained. New structures are generally much cheaper to maintain than used structures. If the company wants to advertise its new operation or attract employees, new structures also tend to be more favourable.

There are also disadvantages to building new structures. Building from scratch may involve greater risks and higher costs. For example, a company may have to invest more initially when deciding to build from scratch to carry out feasibility studies. There may also be problems with local labour, local regulations and other obstacles that arise from new construction projects.

Investment in brownfield sites

With brownfield investments companies explore available buildings in the foreign host country that are compatible with their business models and/or production processes. If the existing national or municipal government requires licences or approvals, the brownfield plant may already be up to standard. In cases where the plant previously supported a similar production process, investments in brownfield sites can be a real coup for the right company.

In an environmental context, the term brownfield can refer to the fact that the land on which a plant stands may be contaminated by the activities of the previous owner. This is distinct from a brownfield investment strategy.

The clear advantage of a brownfield investment strategy is that the building is already constructed, thus reducing start-up costs. Construction time can also be avoided.

Investment in brownfield sites, however, runs the risk of leading to the loss of the buyer's money. Even if the premises had previously been used for a similar operation, it is rare for a company to find a facility with the right kind of capital goods and technology for its purposes. If the property is rented, there may be restrictions on the type of improvements that can be made.

Managing risk in Africa calmly and professionally

Thanks to important bilateral recognitions and collaborations with institutions, port agencies etc, for your economic breakthrough in Africa, AEDIC offers the opportunity to enter a safe harbour, with tax benefits and tax relief for 10 years, concessions and low cost of highly educated skilled labour in central location in AFRICA.

When you have decided to act, we provide you with all the essential risk management tools throughout the investment lifecycle.

Aedic with its consultants has the opportunity to bring you into Central Africa and take a position where the industrial city of Kribi will be built.

Watch this video to better understand what we are talking about.

[su_youtube url="https://www.youtube.com/watch?v=P0savsBM0CA" title="investing in africa in Kribi (Cameroon)"]

what do you want to do now?

if you wish to get in touch with us to develop your business opportunity in Africa, please fill in the form below and one of our consultants will contact you within 24 hours

Error: Contact form not found.