Strategic alliances are formal medium to long-term arrangements between two or more parties (mainly, but not exclusively, companies), aimed at achieving specific objectives, functional to the competitive strategies or growth in foreign markets of the individual partners involved. They may concern commercial purposes, or the organisation of production, the development of technological innovations, the implementation of strategic projects.

Development Strategy

In an international business development strategy, alliances can generate the following possible benefits:

- immediate access to distinctive resources and competencies complementary to their own opportunities to exploit their resources and distinctive competencies in new geographical contexts;

- possibility to reach more rapidly the critical size, in terms of invested resources and supply volumes, necessary to be competitive in international markets and to operate at adequate levels of efficiency;

- development of a better knowledge of the characteristics of the foreign market, its competitive dynamics, and the economic and extra-economic factors that influence its evolution;

- greater flexibility and ability to adapt to the specificities of demand in different countries and to the different stage of its life cycle.

International Joint Ventures

They are also very popular joint venture international; it is a new company formed by two or more operators of different nationalities for the purpose of carrying out clearly specified activities of common interest. Once the objective has been achieved, or the conditions of common interest have ceased to exist, the JV can be dissolved or transformed. The JV is thus the result of an agreement between the parent companies (the companies involved) thus characterising their structure and operating methods

They can be considered the most advanced form of a strategic alliance from the point of view of the strategic, organisational and financial commitment of the parties involved. Participation in the formation of the JV, in fact, is determined by the contribution by the parent companies of financial capital but also of material and immaterial resources necessary for the activities for which it is created.

Joint Venture Models

There are two prevalent JV models finalised to entering a foreign market.

The first provides for the establishment, with one or more local partners, of a new structure whose mission becomes precisely the commercial development of certain products in the market-target. In this case, the company brings production capacity and product knowledgewhile the partner(s) in the target country provide marketing expertise and the availability of a distribution network in the local market.

The second model involves two or more companies (even from different countries) combining their capacities in a certain business area to enter a given market by leveraging scale and a joint positionand therefore with better capabilities and competitive opportunities. In this case, each partner brings its own expertise in the business in which the JV will be active.

As you can imagine, using a JV as a way of entering a foreign market has certain advantages and allows Italian SMEs to

- reduce financial investment and organisational complexity;

- determine a clear separation of the competitive position in the foreign market from the company's traditional activities;

- allows one to enter a foreign country with a company structure equipped with more suitable resources and skills than the company would have individually;

- determines the development of a corporate structure - the JV itself - that can lead to new competitive opportunities.

what do you want to do now?

You want to stay in Europe with a recession just around the corner, galloping inflation and rising gas and electricity costs, and a shortage of raw materials, o would you like to get in touch with us to develop your business opportunity in Central Africa?

If you would like to know more, please fill in the form below and one of our consultants will contact you within 24 hours.

Managing risk in Africa calmly and professionally

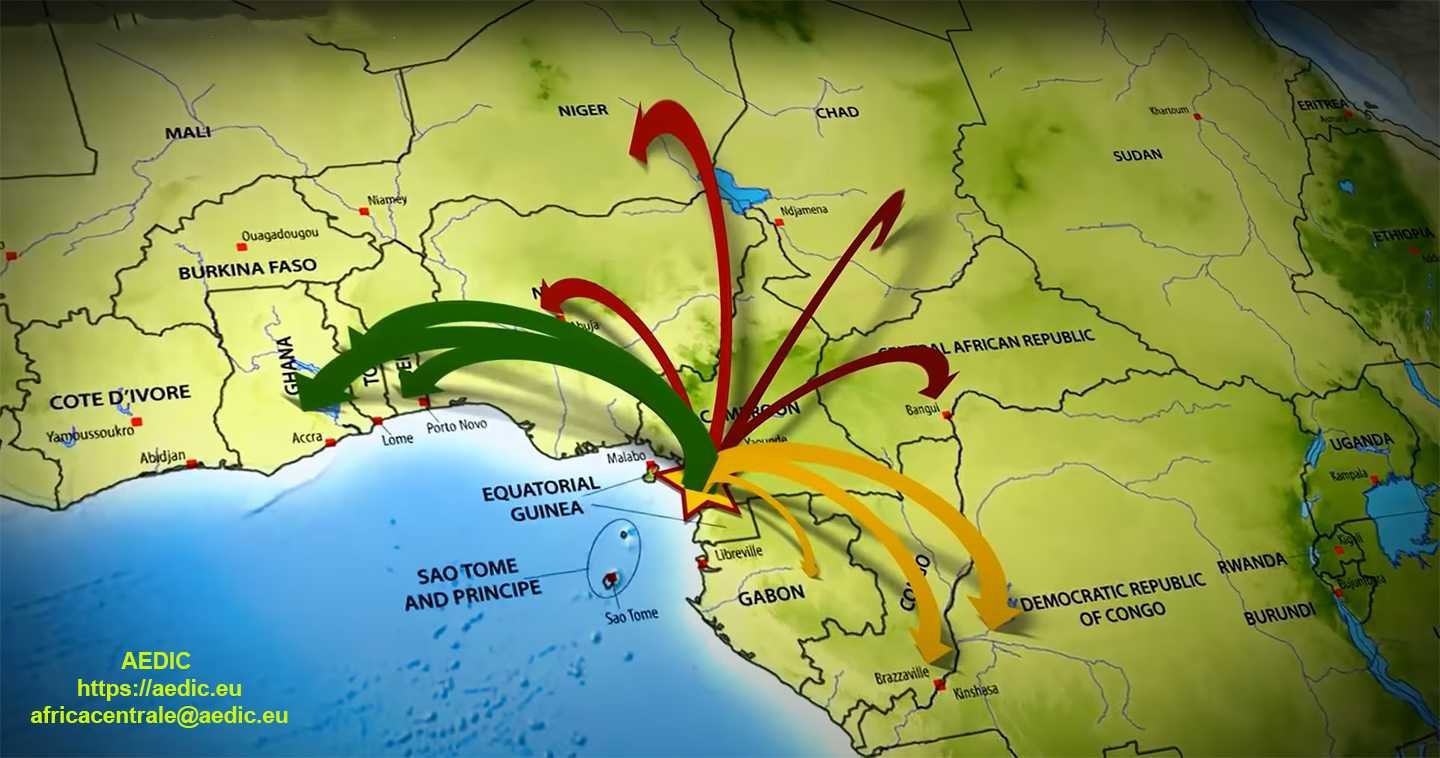

Thanks to important institutional recognitions and collaborations with port agencies, for your economic breakthrough in Africa, AEDIC offers the opportunity to enter a safe harbour, with tax benefits and tax relief for 10 years, concessions and low cost of highly educated skilled labour in position central in AFRICA.

When you have decided to act, we provide you with all the essential risk management tools throughout the investment lifecycle.

Aedic with its consultants has the opportunity to bring you into Central Africa and take a position where the industrial city of Kribi will be built.

Watch this video to better understand what we are talking about.

if you wish to get in touch with us to develop your business opportunity in Central Africa, please fill in the form below and one of our consultants will contact you within 24 hours