Introduction

Developing a sector analysis means presenting the sector (or sectors) in which the company will operate, through the identification of direct competitors, barriers to entry and exit, the bargaining power of customers and suppliers, the strengths and weaknesses of the most relevant players in the sector, through a benchmarking approach to the strategies of others.

Definition of sector

But what is the sector? In a broad sense, the sector is a collection of companies producing similar products/services. In a narrower sense, the sector is the environment in the which the company will operate, characterised by a set of factors that may influence its choices and results.

Consequently, thesector analysis consists of an analytical and integrated understanding of these factors, in order to assess the scope for effective distinctiveness and identify the presence of a competitive advantage for the business venture.

A correct sector analysis must start with a precise definition of the target sectors, in order to identify who the most important competitors are, and then implement an analysis quantitative and one qualitative.

Identification of sectors

In order to be able to accurately identify the reference context of a company, it is essential to consider all possible characterising sectors.

In order to identify these sectors, a number of classifications come to our aid that can represent the economic activities of a country and thus define its sectoral macro-structure. In Italy, the classification ATECO (ECOnomic Activities). This is an alpha-numeric classification of a hierarchical type: the letters indicate the macro-sector of economic activity, while the numbers (ranging from two to six digits) represent, with varying degrees of detail, the articulations and breakdowns of the sectors themselves.

Identifying competitors

The first step in carrying out an industry analysis is to identify the company's competitors. But which and how many competitors to select? The main risk is either to widen the enclosure too much, to the point of including realities that do not actually compete with the company, or to narrow it down too much, forgetting to analyse players that do not propose an offer comparable with their own but which could nevertheless represent a threat.

Intuitively, much of the information on competitors can be found through the personal knowledge industry or through search engines. However, for a complete overview it may be useful to rely on ATECO (or similar) codes to identify, from specialised databases (AIDA, AMADEUS, OSIRIS), all enterprises that belong to the same group of codes. After a careful analysis of the collected companies, it will be possible to define the set of companies that best reliably represent their sector.

Quantitative sector analysis

This part of the analysis aims to provide concrete (monetary) values of the sector to understand itsattractiveness and the structureand deduce important implications for business strategy.

Attractiveness

Attractiveness can be measured in terms of size and growth rate.

La size provides a static snapshot of the economic attractiveness of the sector. This data must be combined with measures that give a dynamic view and capture trends in the sector over a 3-5 year time horizon. The index CAGR (compound annual growth rate) makes it possible to represent the growth rate average of a certain initial value (sector size) for a given time span.

CAGR(t0,tn)=(V(tn)/V(t0))(1/(tn-t0))-1CAGR(t0,tn)=(V(tn)/V(t0))(1/(tn-t0))-1

V(t0)V(t0) is the initial value, V(tn)V(tn) the final value and (tn-t0)(tn-t0) the number of years in the period considered.

Calculation of CAGR

The Structure

The structure can be analysed with concentration indices which measure the market share controlled by the largest companies operating in an industry to see whether it is an industry with a few corporate giants (concentrated) or with many similar smaller companies (fragmented), or with intermediate values. There are several formulas including the Gini coefficient or theHerfindal - Hirschman index.

Qualitative sector analysis

Strategy studies provide a number of qualitative tools that can describe the target sector from several points of view.

Porter's 5 competitive forces

According to Michael Porter, one of the most celebrated names in the world of strategic analysis, these actors can best be identified in five competitive forces, three of which are horizontal and two vertical along the enterprise value chain.

Le horizontal forces link competitive actors operating on the same level of the value chain. Competition is represented by the companies currently operating in the sector (identifiable by the methods described in the sector definition section). The presence of substitute products refers to the propensity of buyers to replace one product with other, alternative products. I potential entrants represent new entrants in the sector (both newly created companies and existing companies but operating in different sectors). The entry of potential entrants is linked to the existence of barriers to entryThe lower these barriers are, the lower the rate of profitability within the sector and the greater the contestability of the sector.

Moving instead to the vertical forceslinks along the enterprise value chain are analysed. Upstream, one finds the supplierswhose bargaining power generally depends on the uniqueness of the product/service offered. Downstream, the buyers who can exert a certain level of bargaining power (through their price sensitivity). These factors impact not on competition in the strict sense, but on the profitability of the sector.

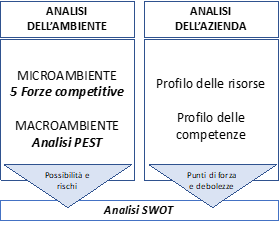

SWOT analysis

SWOT analysis allows an external analysis of the industry to be combined with the critical internal success factors of the company. Internal factors consist of strengths (Strenghts) and weakness (Weaknesses) that put the company in a competitive position of advantage/disadvantage over its competitors. External factors can be supportive (Opportunity) or brake (Threats) to the implementation of profitable strategies for the company. The analysis of these factors helps to answer questions such as:

- Do strengths open up new opportunities?

- Do strengths make it possible to manage opportunities?

- How to turn weaknesses into strengths?

- How to neutralise threats?

The PEST(EL) analysis

A final type of sector analysis, understood in a broader sense than what has been analysed so far, is the analysis PEST (acronym for Political, Economic, Social and Technological factors) o PESTEL (with additional Ecological and Legal factors) to scan the macro-environmental factors influencing (directly or indirectly) the business activity.

The proposed tools, integrated between them, they provide an overview of the critical issues that could be encountered in structuring the business.