Introduction

At a time in history when the network relations are fundamental, it becomes interesting to understand how companies are actually creating partnerships aimed at establishing real supply chains. For this reason, some operational models highlighting forms of integration between the parties. It is necessary to premise that there are two forms of integration, vertical and horizontal.

L'vertical integration involves actors belonging to the same supply chain who are positioned at different levels of the 'chain'.

The iHorizontal integration (also called co-opetitioncollaborative competition), on the other hand, sees the realisation of partnerships between players belonging to different or competing supply chains.

The most common relationship models for these two classes of integration are listed below:

- Vertical integration

- Milk Run

- Kanban

- Vendor Managed Inventory

- Consignment stock

- Just In Time

- Horizontal integration

- Central Purchasing

- Re-badging

- Private label

Vertical integration

As part of thevertical integration operational models can be presented that assume a agreement between the parties (supplier-customer) medium to long term. Each model, in fact, presupposes a common information system capable of transmitting the information necessary for coordination. The relationships are also based on a relationship of trust necessary to be able to share information about stocks and sales. With these prerequisites in place, the following forms of integration can be realised.

Milk Run

The Milk Run is an organisational model in which the distribution or procurement phases are optimised through a collection or distribution service carried out by a number of operators. In the case of distribution, for example, the supplier plans a trip in which he will deliver materials to his customers, grouping several deliveries in a single trip.

The Milk Run is a periodic, predefined 'round' that has among its advantages:

- the reduction of transport costs;

- optimisation of loading/unloading phases.

The Milk Run can be seen as a simple form of SCM, in that it involves coordination with one's suppliers and/or customers, since there must be an agreement on the times of collection or delivery. In the case of a Milk Run with its suppliers, in fact, each supplier must prepare the material at a certain time and in a certain way in order to facilitate loading at the time the collection service passes.

Vendor Managed Inventory

In Vendor Managed Inventory (VMI) the management of material in a customer's warehouse is ensured by the supplier. An agreement is signed between the two parties in which the supplier undertakes to monitor, the stock status of certain items in the customer's warehouse, and to replenish in order not to allow stock out. The agreement between the parties emphasises that the material must be present in the customer's warehouse in a quantity not exceeding an agreed threshold, just as the quantity to be replenished must not exceed certain ranges. With VMI the supplier consolidates a relationship with the customer through a medium-term partnershipwhile the customer is guaranteed optimal stock management of certain materials without the risk of stock-outs, as well as reduced order handling costs, as they are no longer needed.

Consignment Stock

The Consignment Stock (C.S.) is a form very similar to VMI except that the ownership of the good in the customer's warehouse is held by the supplier until it is taken for its use. With this model, the customer has an additional advantage, which is the reduction of its working capital. The supplier, on the other hand, can take advantage of reduced warehouse requirements by placing the material with his customers.

Just-In-Time

The Just-In-Time (JIT) is one of the organisational models developed by Toyota in its Toyota Production System. Again, this requires a customer-supplier agreement in which the supplier commits to supply its customer with defined and very short lead times. The JIT allows the customer to maintain the very low stock level in the warehouse. In particular, the material is held by the supplier, ready to be shipped to the customer at the desired time and in the desired quantity.

Kanban

The Kanban is a form of integration in which the sharing of certain rules between customer and supplier makes it possible to keep stock status under control. Kanban, a tool present in the TPS, provides for stocks at the customer's premises to be kept under control through the exchange of visual signals (originally tags, also known as Kanban) that trigger upstream actions. Stock replenishment actions only start on demand, realising the pull model and eliminating the risk of creating overproduction or overstocking. Kanban therefore allows the maintenance of optimal stocks at the customer, eliminating the purchasing and requirement forecasting phase. Customer and supplier must share rules for activating the upstream process (time and methods) following prior agreements.

Horizontal integration

As part of thehorizontal integrationinstead, the co-opetition has received increasing attention in the academic literature only in the last decade. It is defined as simultaneous cooperation and competition realised between entities that usually sell their products in the same market segment. Co-opetition seen as a business strategy implies that the entities of the new organisation should co-operate and compete simultaneously to achieve common goals and targets through joint distribution activities. This strategy may lead to improve distribution efficiency and effectiveness of supply chain operations. Precisely because the supply chain is a dynamic network, its constituent actors have always been exposed to variation and instability giving rise to conflict and/or opportunistic behaviour due to the uncertainty and ambiguity of certain situations. This paradoxically generates a certain need for cooperation and collaboration.

The results of co-operation for a company include both financial results and process improvement through learning from co-operative partners. Co-opetition strategies can help companies to share costs, mitigate risks and achieve economies of scale. Therefore, co-opetition can improve the efficiency and effectiveness of companies and create a win-win situation with lower overall costs (Chin et al., 2008).

Benefits

As for the non-financial benefits, scholars suggest that companies also co-operate with competitors in research and development in order to gain access to competitors' knowledge and skills that can then be internalised in their own company. Numerous studies have shown that, through co-opetition, partners can develop a common knowledge base from the expertise of all companies involved. Co-opetition only becomes an unprofitable strategy in the case of highly innovative products or solutions.Three municipalities forms of co-opetition have been consolidated in two very important sectors, namely the large-scale retail trade and the automotive sector. The forms of co-opetition are:

- Central buying stations for the large-scale retail sector;

- Private labels in the large-scale retail trade;

- Re-badging in the automotive sector.

Central Purchasing

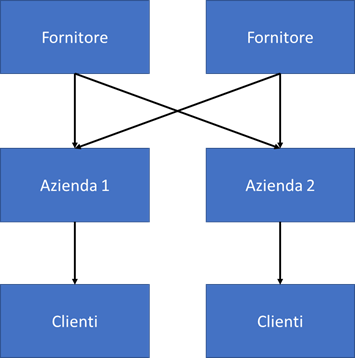

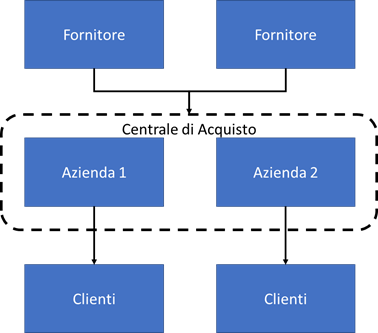

La Central Purchasing is an alliance that aims to centralise negotiations. Centralisation is "the degree to which authority, responsibility and power are concentrated within an organisation or purchasing unit" (Bals et al., 2018). Suppose that in one unit several organisational units individually purchase materials directly from different suppliers. This is a fully decentralised procurement system and is depicted in the figure below with arrows representing the directions of the main flows.

The centralised purchasing system has multiple advantages, such as the reduction of multiple invoicing, the possibility of achieving economies of scale and thus better prices for integrated companies. Centralisation occurs when, in the large-scale retail trade, several retailers aggregate into one centralised unit and place cumulative orders. The material is then distributed by the suppliers to the different distribution centres for onward delivery to the points of sale.

Private label

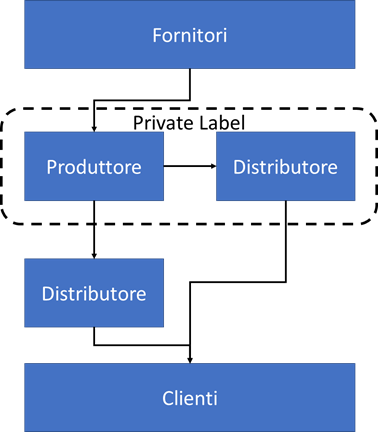

I private labels are the specific products of a chain shop and cannot be purchased from competing retailers. They are controlled by the retailer or distributor who holds the exclusive rights and are usually made by a third-party manufacturer.

The latest data compiled for the International Private Label Yearbook of the PLMA of 2019 show that in 17 European countries the market share for the private label is more than 30%. Spain, Switzerland and the United Kingdom are at the top with the highest market shares of 50% or more of the 20 countries researched by Nielsen. (PLMA, 2019).

The recent economic crisis has made the situation easier for private labels as consumers turn to them in search of cheap products that offer good value for money.

Usually, with the application of the distributor's mark, the following are possible two scenarios: the private label product replaces the manufacturer's branded product; the distributor's branded product is added on the shelf to the manufacturer's branded product.

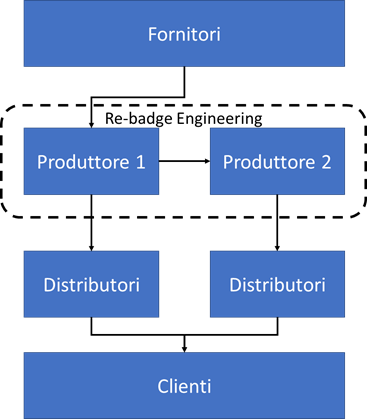

Re-badging engineering

Re-badging engineering occurs when a manufacturer buys another manufacturer's rights to an existing model, affixes its own logo and sells it as a separate product. This technique is often used in the car industry. In this situation, no 'engineering' is done on the cars; in some cases, a slightly altered exterior design is used while in others, different engines or transmissions are used.

Re-badging engineering is considered an economical way to introduce a new model as the time needed for research and development (R&D) for design and testing is practically eliminated.

A car has an expensive development phase and this phase may not be profitable, especially if the expected sales figures are not achieved afterwards. This strategy is often used within models belonging to the same group (e.g. General Motors, Volkswagen, etc.).

There are cases in which a car company decides to acquire the rights to a model from another company in order to introduce a new model in a market segment (e.g. Mitsubishi, FCA). The advantages are mutual: the manufacturing company that developed the vehicle has the opportunity to recover its research and development costs; the company that acquires the rights has the opportunity to introduce 'new' vehicles quickly and easily without incurring huge development costs.

Conclusions

From the analysis of the cases of vertical integration e horizontal some common conditions.

- Medium to long-term agreement between the partners.

- Mutual benefits through a winning strategy.

- Shared information systems.

- In Co-opetition, the products sold by the partner are the same or with minor modifications but compete in the same market, so the products are competitors in front of potential customers.

As far as the processes and management of SMEs are concerned, they too experience criticalities. This is because SMEs often are not big enough to justify centralised supply chain management organisations involving large corporate employees in various business functions.

Therefore, small and medium-sized enterprises must be aware and should have the ability to improve their performance in terms of efficiency, optimise the use of resources, eliminate uncertainty, ensure consistency of service and customer satisfaction, introduce new products to hold the market against competition, maintain market visibility and reach.

Bibliographic and web references

Articles

Ilaria Mariotti, Transport and Logistics in a Globalizing WorldA Focus on Italy

Gino Marchet, Marco Melacini, Shaping the international logistics strategy in the internationalisation process, January 2016, International Journal of Supply Chain and Operations Resilience 2(1):72

Robert Rogaczewski, International logistics under conditions of business activity internationalisation and integration Poznan, December

ue.poznan.pl ' R.Rogaczewski_WP_10_2013.pdf

Kersten, Wolfgang (Ed.); Blecker, Thorsten (Ed.); Ringle, Christian M. (Ed.), Digitalization in Supply Chain Management and Logistics: Smart and Digital Solutions for an Industry 4.0 Environment Proceedings of the Hamburg International Conference of Logistics (HICL), No. 23

www.econstor.eu ' bitstream ' hicl-vol-23

Payaro Andrea ,Papa Anna Rita , (2020 ) "Co-opetition in Supply Chains. The Cases of Three Large Market Leader Companies" , International Journal of Management and Applied Science (IJMAS) , pp. 53-60, Volume-6,Issue-5

Payaro Andrea, Papa Anna Rita , (2019), Supply Chain Management implementation in Italian SMEs, A proposed taxonomy. International Conference of Business and Management in Emerging Markets ICBMEM 2019OCTOBER OSLO, NORWAY

Aziz Muysinaliyev, Sherzod Aktamov, (2014), Supply chain management concepts: literature review, Journal of Business and Management. Volume 15, Issue 6

Sites

Council of Supply Chain Management Professionals (CSCMP)

Supplychain247

Supply Chain Management Review

Payaro Andrea